Economic and Market Update - May 2022

May 31, 2022

- Lockdowns in China have put significant pressure on China’s economy, with April’s data on credit growth, industrial production, and retail sales all falling faster than expected. Shanghai has begun to reopen slowly, which is positive, but still not at pre-lockdown levels.

- European Central Bank President Christine Lagarde has signaled upcoming rate hikes through the summer and expects that interest rates, which are currently negative, to be at least at 0%, if not positive, by the end of the 3rd quarter.

- New home sales in April fell for the 4th consecutive month, as higher mortgage rates squeeze affordability. But prices have remained elevated due to the low supply of homes.

- The S&P 500 snapped 7 consecutive weeks of negative returns in the week ending 5/27/22. The index rose 6.58% last week and is now down –12.76% year-to-date. The rally came amid signs of easing inflation and expectations for less aggressive interest rate hikes from the Federal Reserve.

- Despite some high profile earnings misses, earnings in the first quarter for S&P 500 companies have been much stronger than consensus. Expectations before reporting began were for 4.7% year-over-year growth versus the reported level of ~11.6%.

- High yield bonds have experienced losses for several months as investors price in risk that higher rates will result in defaults. This riskier segment of bonds was down ~13% from 1/3/22—5/18/22, but did rally nearly 5% along with stocks last week.

Broad employment trends have continued to strengthen, especially in the U.S., however certain employers may be less able to cope with tightening financial conditions. Layoffs at start-up companies, which typically have tighter margins and less free cash flow than most, have risen this year. Higher interest rates could be making it more difficult for these companies to access capital, which may be resulting in cost cutting through layoffs.

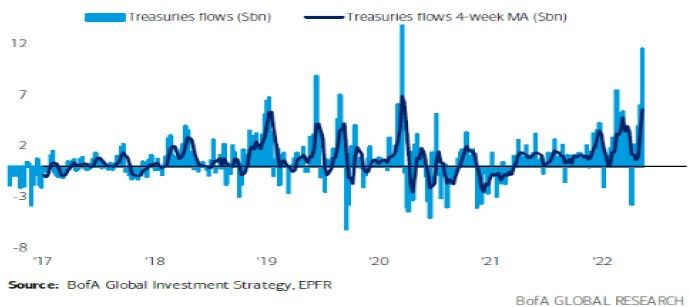

With interest rates at relatively higher levels and equity volatility picking back up in April and May, purchases of U.S. Treasury bonds accelerated. Treasuries saw the largest inflow since March of 2020 this month. The inflows could be a sign of investors seeking the relative safety of Treasuries or potentially that most of the Federal Reserve’s rate hikes have been priced in and expectations for higher yields may be moderating.

Markets have continued to grapple with the outlook for inflation, interest rates, and economic growth. More recently, the stock market has been able to rally on early signs that inflation may be peaking, based on Consumer Price Index and Personal Consumption Expenditure reports. The implication is that if inflation begins to peak and recede, the Federal Reserve may be able to become less aggressive with their interest rate hike plans. Less aggressive interest rate hikes would potentially mean less of a slowdown for economic growth, which is generally a more favorable environment for equities. The speculation still lies in how quickly inflation may begin to recede. Even if inflation has peaked, if it takes longer than expected to come down from the still very elevated levels, the Fed may not be able to pump the brakes on raising rates. The next few months will be informative. The setup for a sustainable rally could be in place if inflation figures fall further, provided consumer spending holds up as well. The Russia/Ukraine conflict and Chinese lockdowns continue to be important factors since they impact both food and energy costs, as well as the on-going global supply chain issues.

The purpose of the update is to share some of our current views and research. Although we make every effort to be accurate in our content, the datum is derived from other sources. While we believe these sources to be reliable, we cannot guarantee their validity. Charts and tables shown above are for informational purposes, and are not recommendations for investment in any specific security.

Categories

Contact A Wealth Advisor Today